The best patient financing solution for your practice.

Help your patients access more

treatments with better financing options.

98% Approval Rating

Financing up to $75,000

Increase Case Acceptance

Low Interest Rates And Longer Terms

We offer lending products that were created to finance dental and medical practices from $2,500 up to $75,000.

We have some of the most flexible and competitive interest rates and terms in the industry which allows us to offer affordable monthly payments for your patients.

Schedule a demo today

You are requesting to have a Client Financing representative reach out to you regarding our customer financing solutions.

Sell More High-Margin Services in 3 Easy Steps

1. We get to know your practice

We'll learn more about your practice and the services you'd like to sell more of.

2. Successfully integrate financing

With a link, embedded application or a live transfer handoff, we're ready!

3. Sell more high-margin services

You'll have a complete lending waterfall, powering you to approve everyone.

Treatments Now, Pay Later Solutions

Remove the number one barrier to selling more client; price, when you partner your practice with Client Financing's treatment now, pay later solutions.

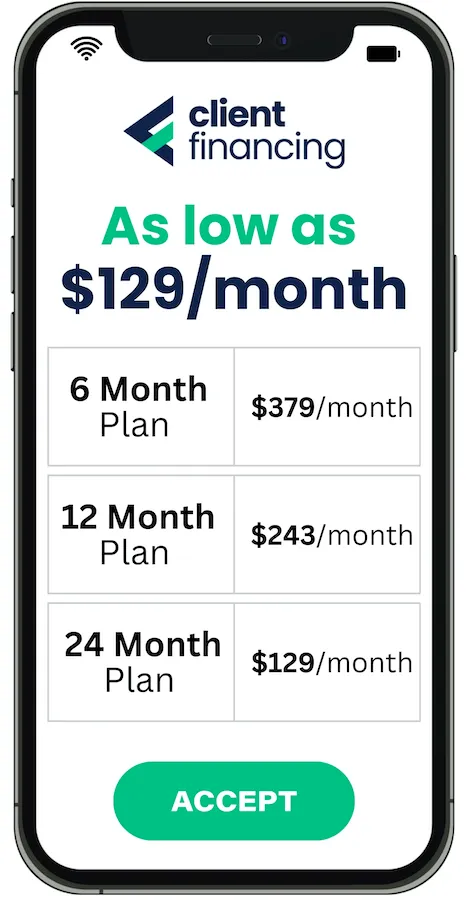

Your price tag isn’t $5,000.

It’s $129 / month.

Increase sales, improve company cash flow, and help your customers by offering premium financing options, third-party customer financing programs, or merchant payment plans from the team at Client Financing.

We Want To Work With You!

Our onboarding process is a breeze with customized links, training

and personalized support designed for your business needs.

Best-In-Class

Support

Your live transfer "Financing Department" solution.

Customized marketing resources for social media, email & video.

Fast US-based phone, email & slack support.

Industries We Service

Cosmetic & Plastic Surgery

Chiropractic & Spine Care

Regenerative Medicine

Chiropractic & Spine Care

Hair Restoration

Vanier & Dental Implants

Cosmetic Beauty Injectables

And so much more....

Empower Your Customers with Financing

Create tailored financing programs, boosting sales, expanding customer bases, enhancing retention, and improving cash flow, driving growth and competitive advantage!

Increase Sales and Revenue

Higher Purchase Amounts:

Financing enables customers to afford higher-priced items by spreading the cost over time.

Boost Conversion Rates:

Offering financing at the point of sale can reduce friction and encourage more customers to complete their purchases.

Upselling Opportunities:

With the availability of financing, customers are more likely to consider add-ons and premium options.

Expand Customer Base

Attract New Customers:

Financing options can draw in customers who might not have considered your products or services otherwise.

Reach Budget-Conscious Shoppers:

Financing makes your offerings accessible to a wider audience, including those with tighter budgets.

Improve Accessibility:

By offering diverse financing plans, you can cater to different financial situations and needs.

Enhance Customer Retention

Build Loyalty:

Customers appreciate flexible payment options and are more likely to return for future purchases.

Increase Satisfaction:

Providing financing solutions can improve the overall customer experience, leading to higher satisfaction and repeat business.

Create Long-Term Relationships:

Offering financing fosters a sense of partnership and trust with your customers.

Maximize Your Business Potential with Easy Customer Financing Solutions

Financing solutions that help businesses sell more by making their products and services more accessible, improving customer satisfaction, and driving long-term growth.

Strengthen Competitive Edge

Differentiate Your Business:

Stand out from competitors by providing value-added services like financing.

Enhance Brand Perception:

Financing solutions can enhance your brand image as customer-focused and supportive.

Gain Market Share:

Capture a larger share of the market by appealing to customers who prefer or need financing options.

Improve Business Cash Flow

Immediate Payments:

Financing companies typically pay you upfront, improving your cash flow while the customer pays over time.

Reduce Financial Risk:

By partnering with financing providers, you mitigate the risk of non-payment and bad debt.

Streamline Operations:

Simplify your sales process with integrated financing solutions that handle credit checks and collections.

Support Business Growth

Scalable Solutions:

Financing programs can grow with your business, adapting to increasing sales volumes and expanding product lines.

Invest in Innovation:

With improved cash flow and sales, reinvest in new products, marketing strategies, and business development.

Enhance Efficiency:

Focus on your core business while leveraging the expertise of financing partners to manage payment plans.

Privacy Policy | Terms Conditions